Exactly How Livestock Danger Protection (LRP) Insurance Can Secure Your Animals Investment

Livestock Risk Security (LRP) insurance coverage stands as a reliable guard versus the unpredictable nature of the market, supplying a tactical method to securing your properties. By diving right into the complexities of LRP insurance coverage and its diverse advantages, animals producers can strengthen their financial investments with a layer of protection that transcends market variations.

Comprehending Livestock Risk Protection (LRP) Insurance

Recognizing Livestock Risk Defense (LRP) Insurance coverage is important for livestock manufacturers seeking to reduce financial threats linked with rate variations. LRP is a federally subsidized insurance product made to protect manufacturers versus a decrease in market value. By supplying insurance coverage for market rate decreases, LRP assists producers lock in a floor price for their animals, ensuring a minimal degree of profits no matter of market changes.

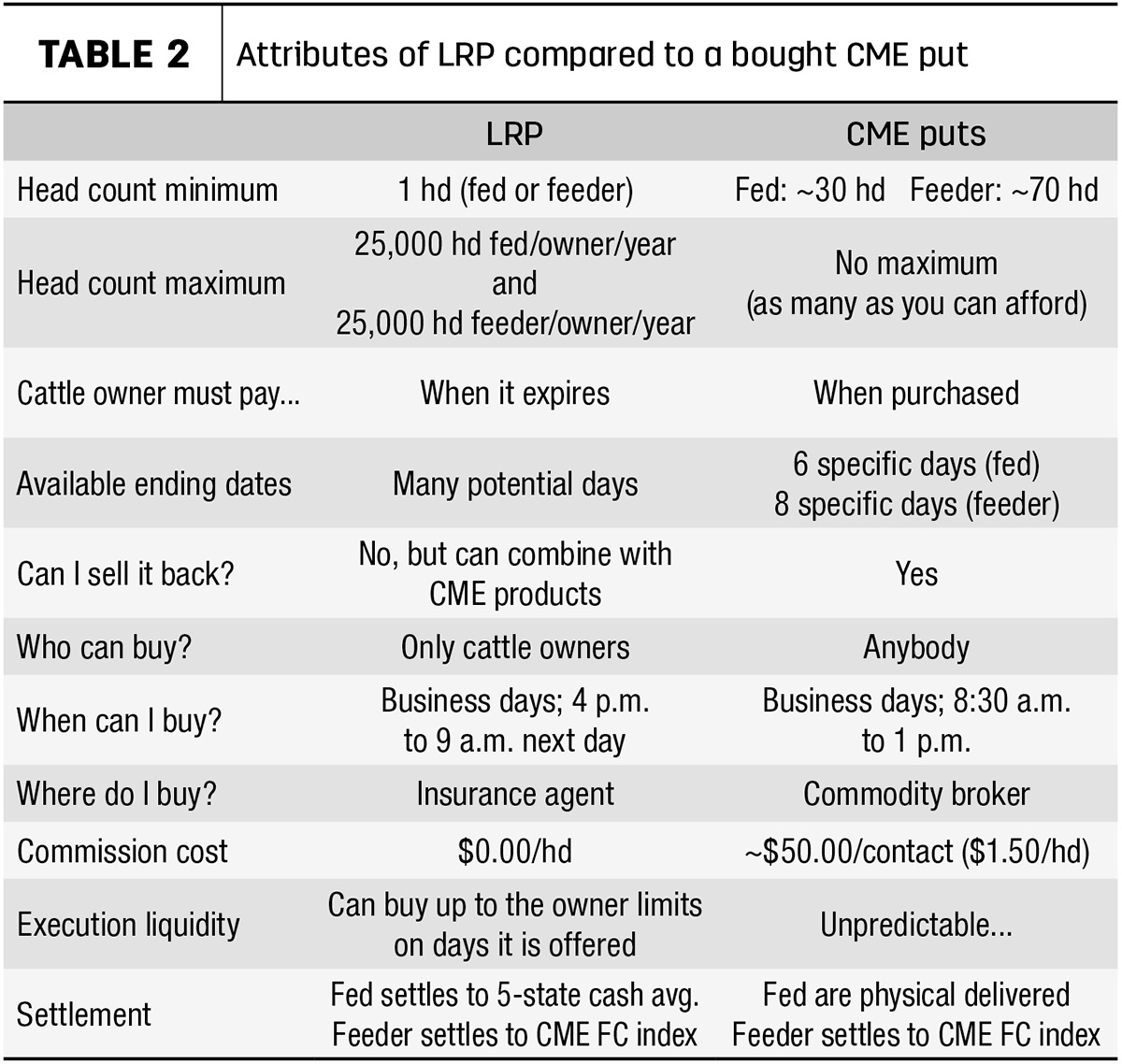

One secret element of LRP is its versatility, allowing manufacturers to tailor coverage degrees and policy lengths to suit their certain requirements. Producers can pick the number of head, weight range, insurance coverage cost, and insurance coverage period that straighten with their manufacturing objectives and run the risk of resistance. Recognizing these adjustable options is critical for manufacturers to effectively handle their rate danger direct exposure.

Furthermore, LRP is offered for numerous animals types, including cattle, swine, and lamb, making it a functional danger administration device for animals producers throughout various markets. Bagley Risk Management. By acquainting themselves with the complexities of LRP, producers can make enlightened choices to guard their investments and guarantee monetary security despite market unpredictabilities

Advantages of LRP Insurance Coverage for Livestock Producers

Livestock manufacturers leveraging Animals Threat Protection (LRP) Insurance acquire a calculated advantage in securing their investments from rate volatility and safeguarding a stable financial footing in the middle of market uncertainties. By setting a flooring on the price of their livestock, manufacturers can minimize the threat of significant financial losses in the occasion of market downturns.

In Addition, LRP Insurance supplies manufacturers with tranquility of mind. In general, the advantages of LRP Insurance for animals manufacturers are substantial, providing a beneficial tool for handling risk and making certain monetary protection in an unpredictable market setting.

How LRP Insurance Coverage Mitigates Market Threats

Reducing market dangers, Livestock Threat Defense (LRP) Insurance policy gives livestock producers with a reputable shield versus cost volatility and financial uncertainties. By using defense against unexpected cost declines, LRP Insurance policy assists producers safeguard their investments and keep monetary stability despite market variations. This sort of insurance policy permits livestock producers to secure a price for their animals at the beginning of the policy period, making certain a minimum rate level despite market changes.

Steps to Safeguard Your Animals Investment With LRP

In the world of farming risk administration, applying Livestock Danger Protection (LRP) Insurance coverage entails a calculated procedure to secure investments against market variations and uncertainties. To secure your animals investment efficiently with LRP, the very first action is to analyze the particular dangers your procedure encounters, such as price volatility or unexpected weather condition occasions. Next off, it is important to study and select a reputable insurance coverage provider that provides LRP plans customized to your livestock and service needs.

Long-Term Financial Safety With LRP Insurance Policy

Making sure enduring financial security through the usage of Livestock Danger Defense (LRP) Insurance coverage is a sensible long-lasting method for farming producers. By integrating LRP Insurance policy into their risk monitoring strategies, weblink farmers can guard their animals financial investments versus unanticipated market changes and unfavorable events that could jeopardize their financial health with time.

One secret advantage of LRP Insurance coverage for long-lasting monetary protection is the comfort it uses. With a reputable insurance plan in area, farmers can minimize the monetary threats linked with volatile market conditions and unanticipated losses because of elements such as disease outbreaks or all-natural catastrophes - Bagley Risk Management. This stability enables manufacturers to focus on the daily operations of their animals service without continuous fret about potential monetary problems

Moreover, LRP Insurance policy offers an organized method to taking care of risk over the long-term. By setting certain protection degrees and choosing proper endorsement periods, farmers can customize their insurance coverage plans to line up with their economic goals and take the chance of tolerance, ensuring a lasting and protected future for their livestock procedures. In conclusion, spending in LRP Insurance policy is a positive approach for farming producers to attain long lasting economic security and safeguard their resources.

Conclusion

Finally, Livestock Risk Security (LRP) Insurance policy is an important device for animals manufacturers to mitigate market risks and safeguard their investments. By comprehending the benefits of LRP insurance coverage and taking steps to execute it, manufacturers can attain long-term monetary safety for their procedures. LRP insurance supplies a safeguard against price fluctuations and makes sure a degree of security in an unpredictable market setting. It is a smart selection for securing livestock financial investments.